What does it take to be considered wealthy? Is wealth based on net worth? How much money is in your bank account? How about monthly income? At any rate, we can agree that wealth is relative.

At Pursuit of Passive Income, we believe that financial freedom is true wealth!

So what does it mean to be financially free? In simple terms, financial freedom means you don’t have to worry about money. Instead of working for money, your money works for you.

True financial freedom exists when your income-producing assets cover your expenses.

So what are the best income-producing assets for you to invest in to generate passive income, build wealth, and achieve financial freedom?

All that and more to come. Let’s get right into it!

What Are The Best Income Producing Assets For Passive Income?

There will always be a certain amount of risk associated with every investment you make. Investments such as real estate or dividend stocks are safe, long-term options, whereas starting a business or lending money to an aspiring entrepreneur carries a lot more risk.

First, here are our favorite options considered to be the best income-generating assets.

1. Online Business

An online business earns the premiere spot on our list of top income-generating assets. While maybe not the most passive in nature, starting an online business is extremely rewarding. When I started Pursuit of Passive Income, I made a point to operate the business like a startup.

I invested in the best tools, and once I developed my processes for creating content and started to see some dollars trickle in, I hired a writer to help with the workload.

This effort to invest the money I was making back into the business allowed PPI to grow into an income-generating asset that is becoming increasingly hands-off. When you run your own business, you have the ability to automate it to the point where you can generate income that is passive.

The best part? Starting a blogging business requires almost no up-front investment, and the income potential is off the charts. On top of that, blogging is a lifestyle business, which means you can operate from anywhere in the world.

Get Started: Sign up to receive our Free Beginner Blogger Course!

2. Dividend Paying Stocks

Dividend stocks are great for consistent cash flow and are entirely passive. These are stocks that pay dividends periodically to their shareholders, which are paid out as cash or received as additional shares of the stock.

If you have confidence in a few publicly-traded companies, research each one to find out if they offer a dividend yield. This Forbes article highlights some of the top dividend stocks for 2023, which is a good place to start.

To better understand dividend-paying stocks as income-generating assets, let’s use Coca-Cola as an example. The Atlanta-based beverage company offers a 2.77% yield which equates to an annual dividend payment of $1.76 per share.

So if you purchase 100,000 shares of Coca-Cola (KO), you will receive $176,000 annually as a dividend payment plus any gains related to the stock price.

Get Started: Reach out to your financial advisor to discuss the best dividend-paying stocks.

3. Real Estate Assets

Real Estate will always be near the top of the list of income-generating assets. Of course, depending on the property, the cash flow you receive can be completely passive or more hands-on. For instance, a multi-family complex with 100 units comes with a lot of headaches while a single-tenant building occupied by Starbucks provides what we call ‘mailbox money.’

At any rate, rental income from real estate properties is excellent for recurring cash flow that you can depend on each and every month. Real estate investing is typically capital intensive as most banks will require a 25% down payment to acquire rental properties.

With that said, if you’re in a position to get started with real estate investing, owning property provides a cushion of rental income to build wealth that comes with numerous tax advantages. As such, real estate is an income-producing asset that we highly recommend.

Get Started: Contact a local real estate broker.

4. Real Estate Crowdfunding

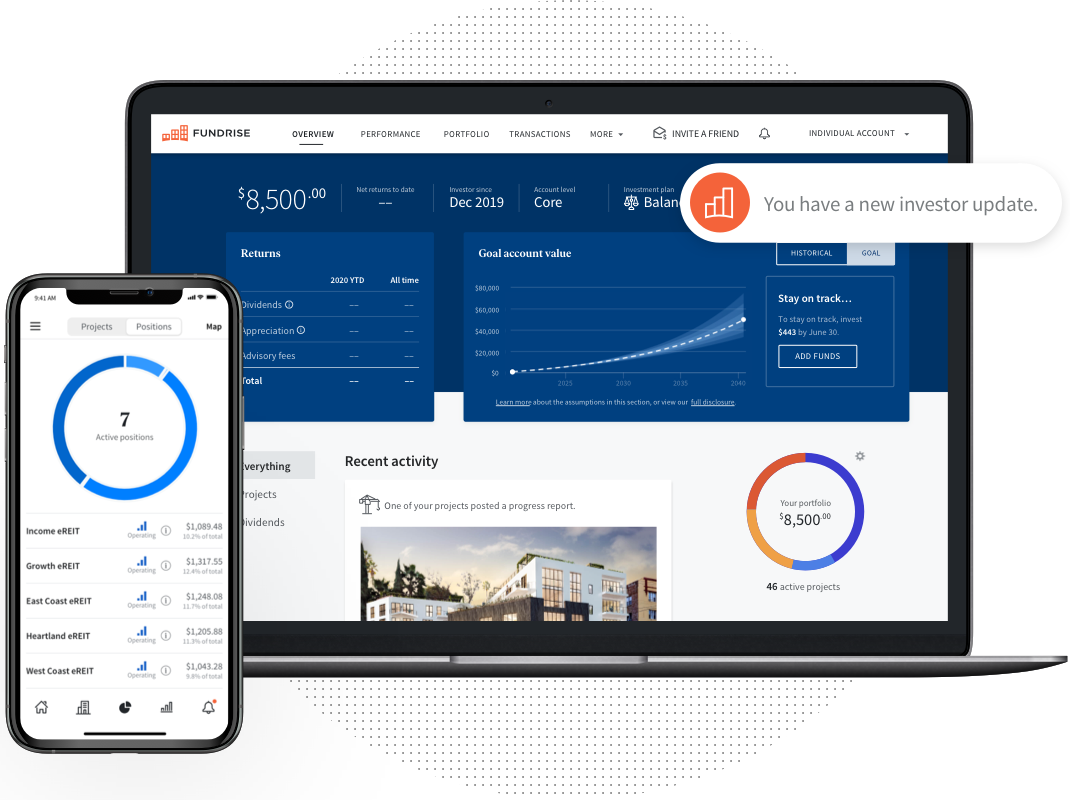

Real estate crowdfunding is a more hands-off approach to real estate investing that is more accessible in that it offers a much more manageable minimum investment.

Rather than owning property, which forces you to take on the responsibility of landlord, property manager, contractor, plumber, and more, real estate crowdfunding allows you to pool funds with a trusted manager to acquire individual properties and portfolios of real estate.

While some real estate crowdfunding platforms are only available to accredited investors, Groundfloor and Arrived allow you to start investing with as little as $10-$100. So for those of you looking to generate cash flow from rental real estate with minimum investment, these opportunities could be for you!

Get Started: Check out some of the best real estate crowdfunding platforms, such as Fundrise, RealtyMogul, and CrowdStreet.

5. Peer-to-Peer Lending

Next on the list, we have peer-to-peer lending. This carries more risk than your traditional income-producing asset, but if you find someone in need of cash that needs to avoid traditional bank financing, the return can be significant.

Those looking to lend money should do so wisely and make sure that any agreement is bulletproof to ensure all the terms are clearly defined and understood. Before committing to anything, make sure you have a detailed understanding of how this person plans to make money and pay you back.

6. Real Estate Investment Trusts

Real estate investment trusts, or REITs, are publicly traded in the stock market as securities that own and operate a large portfolio of real estate.

Most of the time, REITs acquire a diverse investment portfolio of commercial real estate assets, operate them for a certain period of time, typically 5-10 years, then sell off the asset once it has appreciated.

For those of you looking to invest money in the stock market, certain real estate investment trusts such as Prologis and Simon Property Group could be a great way to generate income. Again, no rental property management to worry about.

7. Certificate of Deposit (CDs)

A certificate of deposit is a guarantee to the bank that you will hold your money in the account for a set period of time. Of course, this means that you will not be able to touch this money for a while without facing stiff penalties, but as a result, the bank will agree to pay you a higher interest rate, typically around 3.80% APY for a 6-month CD.

So the upside is the higher interest rate, but the downside is that this money will be unavailable to you for a certain amount of time. Of course, the return is slightly lower than your typical income-producing asset, but it is also one of the safest investments you can make, assuming the bank is financially stable.

8. Bonds

A bond is a loan taken out by the government or large corporation, typically to fund a large infrastructure project or initiative. When they issue a bond, consumers then have the opportunity to buy this debt on the open market and receive payments over the life of the bond.

Bonds are much safer investments than your typical individual stocks, with many investors picking up some bond index funds to boost their portfolio diversification.

The most common types of bonds are as follows:

- Corporate Bonds: Bonds issued by a large company to fund big projects or fuel certain growth activities.

- Treasury Bonds: The federal government issues treasury bonds to finance its debt payments. Treasury bonds carry very little risk.

- High-yield Bonds: High-yield bonds are more risky investments issued by companies at risk of default. As such, they typically come with higher interest rates for the owner of the bond.

- Municipal Bonds: Local governments issue municipal bonds, otherwise known as munis, to raise money for infrastructure projects like bridges, roads, stadiums, transportation projects, and more.

9. Farmland

Farmland may not be one of the most attractive investments, but a farm can be a great way to earn income if you’re interested in alternative investments.

The need for fresh produce and other foods will never go away, and as the number of farms decreases, the demand for the products will continue to rise. Investing in farmland is generally a safe investment with low volatility (other than certain weather patterns), but the downside is that it is illiquid.

Bonus: For those interested in farming, check out The Biggest Little Farm, one of my favorite documentaries about building a sustainable farm from scratch.

10. Franchise Businesses

Investors with more in-depth business knowledge and training and a significant amount of money to place should consider acquiring a franchise such as McDonald’s, Taco Bell, or 7Eleven.

Not only does owning and operating a franchise give you complete control over a business that you can eventually automate with the right people and systems, but it also gives you the ability to generate income through real estate.

One of my largest clients as a commercial real estate agent was a Taco Bell franchisee that bought the real estate, developed the property, then leased it back to his Taco Bell business. So not only is he a business owner, but he is his own landlord, earning passive income that also helps him keep a lot more of his hard-earned cash come tax time.

Once you’ve built up a large store count (typically 10+ locations), you will start to access private equity investing opportunities to further boost your growth.

11. Index Funds

Index funds are made up of a collection of individual stocks tailored to offer a safe long-term investment with a reasonable return based on certain industry benchmarks.

Index funds are popular investment options for retirement accounts such as IRAs and 401K accounts. They are also a great option for the common investor to purchase a stake in all S&P 500 companies at a low cost offered by an index fund.

12. Savings Accounts & Money Market Accounts

For those of you that want to stay away from the more common income-generating assets such as real estate, stock market investing, and more, high-interest money market accounts could be a great option.

With interest rates ticking up as we move into 2023, choosing a high-yield savings account or money market account might make more sense than it has in the past. This is one of the safest passive income streams that is often overlooked due to recent market conditions.

13. Exchange Traded Funds (ETFs)

Similar to index funds, exchange-traded funds (ETFs) offer a portfolio of individual stocks curated by investment professionals to track specific industries such as healthcare, construction, telecommunications, and more.

Most ETFs are automated and managed passively, which helps keep costs and volatility to a minimum while providing the everyday investor with a safe investment in emerging industry categories.

14. Car, Truck, or RV

The ability to rent out your car, truck or RV has become more prevalent over the last five to ten years, providing an excellent opportunity to earn money on the side. Sure, you can list your car on Turo or drive for Uber, but those willing to be more creative can make a better return.

I know people who bought a camper and renovated the interior only to rent it out on sites like RVShare. Depending on the experience, you can make back your entire investment in just about a year or so, then move on to finding the next one to buy and rent.

15. Solar Panels

For homeowners out there, consider investing in solar panels to earn money, save on electricity costs, and improve the environment.

Outfitting your home with solar power qualifies for federal tax breaks. Some states will purchase excess energy from individual homeowners and distribute it back into the local power grid.

Taking this step towards clean energy for your home requires a lump sum investment upfront, so make sure you complete thorough research beforehand if you plan to seek a return for your efforts.

Tips For Buying Income-Generating Assets

Making investment decisions require proper care and attention to detail. Here are a few tips as you search for your next investment.

Set A Budget

Yes, most investments are geared to help you generate consistent cash flow and earn passive income. With that said, not all investments are safe, so with any investment you make, you need to be prepared to lose that money.

Set a reasonable amount of cash aside to deploy into the market with the understanding that you may never see a return on it, and in some cases, the value could diminish.

Once you’ve set your budget, identify which type of investment makes the most sense for your personal situation and formulate a plan you are comfortable with.

Make Confident Decisions

When I first started investing my hard-earned income, I was so quick to find something wrong with each opportunity and kept shooting holes in the numbers.

The reality is that the numbers will never add up how you thought they would, and if you’re scared to act, you’ll be sitting in the same position for years and years.

Keep Liquid Cash on Hand

There are plenty of “gurus” out there claiming that cash is useless, and while there is some truth to this, you need an emergency fund for personal reasons, and you never know when that next investment opportunity will arise.

For me, I saved up and eventually found an opportunity to invest in a Starbucks development that required about $50K to be included. Had I not had that money in my account, I would have missed out on one of the best investments I’ve ever made.

Take Action

This is the most important tip related to investing in income-producing assets. There is the common phrase, ‘scared money don’t make money,’ and it’s true.

Again, the numbers aren’t always going to be perfect. There will never be a perfect time to invest. So when you get a good feeling about something, take the leap and jump in.

You will thank yourself for taking action five years from now, which brings us to our next point.

Expand Your Investment Horizon

Most people don’t invest because they don’t want to part ways with their hard-earned savings. They want that new shiny object they’ve had their eyes on. But trust me, if you can think about your investment 10 or 20 years from now, you will be able to see clearly what it can do for your life.

When I started Pursuit of Passive Income, I wasn’t planning to make money in the first couple of months or even the first year. I was considering what my life would look like 20 years later.

So keep in mind that time goes by quickly, especially as you get older, so if you look at an investment based on what it will do for you 20 years from now, the desired results become much more attainable.

Final Thoughts

Your financial future is on the line. The sooner you invest in income-producing assets, the more you will learn and earn over the course of your life.

Typically, returns on the types of assets outlined in this article become increasingly favorable as time goes on. So be patient, expand your investment horizon, and above all, take action!

For those of you interested in starting an income-producing blog, make sure to sign up for the Beginner Blogger free course!

Other than that, let me know what income-producing assets you’ve purchased and how they perform. As always, we wish you nothing but success.